17 Oct Workforce by the numbers: Business and finance still our economic engine

Charlotte Works is pleased to continue Workforce By The Numbers, spotlighting workforce research from around the region. Data and analysis are provided through our partnership with the Charlotte Chamber.

With the great recession in our rear-view mirror, employment in business, finance, sales and marketing are well above pre-recessions levels and forecast to experience stable growth over the next few years. These occupations comprise the largest of the sectors we’ve analyzed, accounting for 174,502 jobs in our region, with 32,996 (19 percent) considered mid-skill (requiring an associate’s degree or some college).

Nearly 20 percent of the mid-skill workers in this sector are at least 55 years old, meaning workforce shortages could be acute in coming years, putting increased pressure on wages and salaries as demand increases as these workers retire.

The rapid job growth in many of the occupations in this sector indicates a level of high demand. So, too, does the fact that employers often cite these workers – and the skills they possess – as being hard to find. Over the last five years, the sector has grown by 12 percent, adding nearly 19,000 jobs in our region. Of those, 2,500 (13 percent) are considered mid-skill employment opportunities. These included bookkeeping, accounting, auditing clerks and sales representatives. Almost one-third of all workers in this sector have an associate’s degree or some college but no degree (the majority of which fall into the “some college” category). Just over half have a bachelor’s or advanced degree.

Industry focus

Employment opportunities for mid-skill workers are spread across dozens of industries including management of companies and enterprises (7.8 percent of all jobs), commercial banking (7.2 percent), offices of physicians (3.4 percent) and hospitals (3.2 percent). Overall, healthcare is not only one of the largest employers, but is also experiencing the highest levels of growth at 16 percent over the last five years. Other industries with high levels of growth include public accountants (15 percent), temporary help services (59 percent) and sales financing (37 percent).

Occupations with two-year training focus

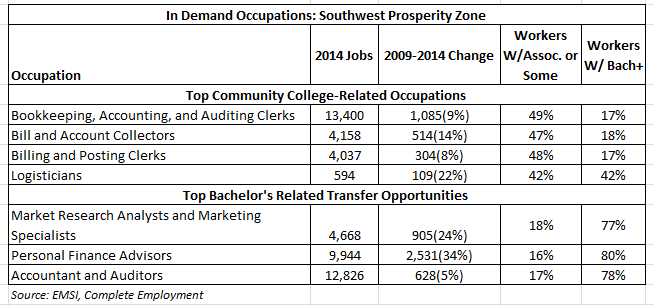

Of the 14 selected mid-skill occupations in the sector that best align with community colleges, booking, accounting and auditing clerks; and bill and account collectors have added the most jobs over the last five years. These two occupations (clerks and collectors) account for 65 percent of the total employment growth within the sector. Of these two occupations, more than 70 percent of employees have a high school diploma or some college and no degree. This occupation pays $17.40 an hour.

At $29.23 an hour, cost estimator is the highest-paying occupation with more than 50 percent of employees having a high school diploma or some college and no degree. Over the next five years, this occupation is expected to grow by six percent.

With 14 percent possessing an associate’s degree and 44 percent having a high school diploma or some college and no degree, logistician is what can best be described as a “stand-out” occupation. With tremendous transfer opportunities, logisticians earn $29.81 an hour, nine dollars more than the regional average. The profession has experienced 22 percent growth over the last five years and is expected to grow an additional 16 percent over the next five years.

At the bachelor’s level and above, there are several high-growth transfer opportunities that nicely fit in a career-pathway model, most notably, market research analysts and marketing specialists, growing by 16 percent over the past five years and paying $32.24 an hour; and personal financial advisors with growth of 30 percent and pay of $35.82 an hour.

As this research has demonstrated, the business and finance sector continues to serve as the economic engine of our region by “filling the gap” while providing long-term employment growth opportunities.

Paul E. Hendershot serves as director of research at the Charlotte Chamber of Commerce. Prior to joining the Charlotte Chamber team, he worked as manager of business development in the commercial real estate department at Dallas/Fort Worth International Airport (DFW) and spent four years as the research director at the Dallas Regional Chamber. During his tenure with the Chamber, Hendershot completed more than 100 unique economic development projects including Comerica, AT&T, Gulfstream, Arbitron, Capital One and Research in Motion. He is also founder and chief economist of Hendershot Economics, where he defined the life sciences industry for BIOCOM, among other projects in the Greater San Diego region.

Paul E. Hendershot serves as director of research at the Charlotte Chamber of Commerce. Prior to joining the Charlotte Chamber team, he worked as manager of business development in the commercial real estate department at Dallas/Fort Worth International Airport (DFW) and spent four years as the research director at the Dallas Regional Chamber. During his tenure with the Chamber, Hendershot completed more than 100 unique economic development projects including Comerica, AT&T, Gulfstream, Arbitron, Capital One and Research in Motion. He is also founder and chief economist of Hendershot Economics, where he defined the life sciences industry for BIOCOM, among other projects in the Greater San Diego region.

Data included in this article is inclusive of North Carolina’s Southwest Region Prosperity Zone, which includes Anson, Cabarrus, Cleveland, Gaston, Iredell, Lincoln, Mecklenburg, Rowan, Stanly and Union counties.